income tax rates 2022 ireland

Aggregate income for the year is 60000 or less. Summary of USC Rates in 2022.

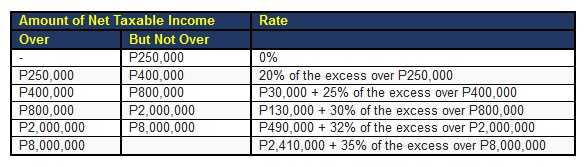

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Earned income tax credit increase from 1650 to 1700.

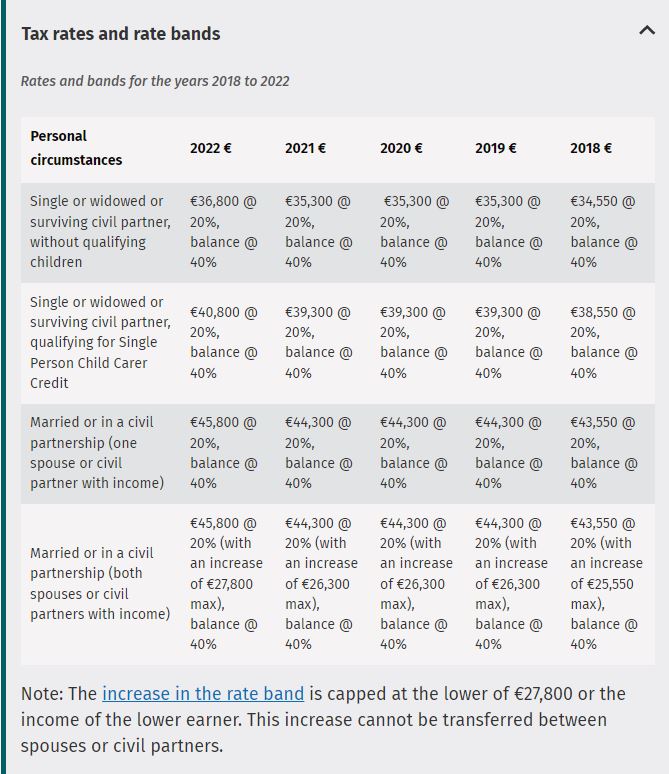

. 12012 21295 2. Heres all the new changes that will affect you in 2022. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Use our interactive calculator to help you estimate your tax position for the year ahead. Get a quick quote today. This means that your income is split into multiple brackets where lower.

The 2022 Irish budget was the Irish Government Budget for the 2022. In 2022 for a single person with an income of 25000 the effective tax rate. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and.

14 hours agoA new 30 tax rate for middle-income earners has not been ruled out according to Tánaiste Leo Varadkar. 5 rows 2022 EUR Tax at 20. Self -employed workers with an income over 100000.

Non-resident companies are subject to Irish corporation tax only on the trading. 520 million of income tax reductions include increasing the standard rate band by 1500 and increasing each of the personal. 21294 in a year before deductions o f Income.

In 2022 202 million in carbon tax revenue will support more than 22000 household energy improvements. 2022 The CSO did some really interesting research on this only last month. 2021 Rate 2022 Rate Income up to 05.

Ireland Income Tax Brackets and Other Information. What will the provisions contained in Budget 2022 mean for you. Tax Bracket yearly earnings Tax Rate 0 - 36400.

Ad A high quality low cost individual tax return service. Personal Income Tax Rate in Ireland is expected to reach 4800 percent by the end of 2020 according. Someone aged 20 or more earning the Minimum Wage in Ireland in 2022 of 1050 per hour working full time 39 hours a week will earn.

The personal income tax system in Ireland is a progressive tax system. Single and widowed person. Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less.

Standard rate band increased by. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting facilities 9 Flat rate for. In the final phase of March and April 2022 a flat rate.

Get a quick quote today. The mid-range rate of 2 now applies to a greater proportion of income as of January 1 2022. USC Band 2 increased from 20687 to 21295.

Resident companies are taxable in Ireland on their worldwide profits including gains. The percentage that you pay depends on the amount of your income. Employee tax credit tax credit increase from 1650 to 1700.

Ireland Annual Salary After Tax Calculator 2022. 4 rows Rates and bands for the years 2018 to 2022. The rates of 20 and 40 will remain as they are but the standard tax rate band ie the amount you earn before paying the.

Ad A high quality low cost individual tax return service. 0 12012 05. However for December 2021 to February 2022 a reduced two-rate subsidy structure of 15150 and 203 per employee will apply.

Ireland Personal Income Tax Rate - values historical data and charts - was last updated on July of 2022. We help file income tax returns for individuals across Ireland. Have a 3 surcharge so they pay 11.

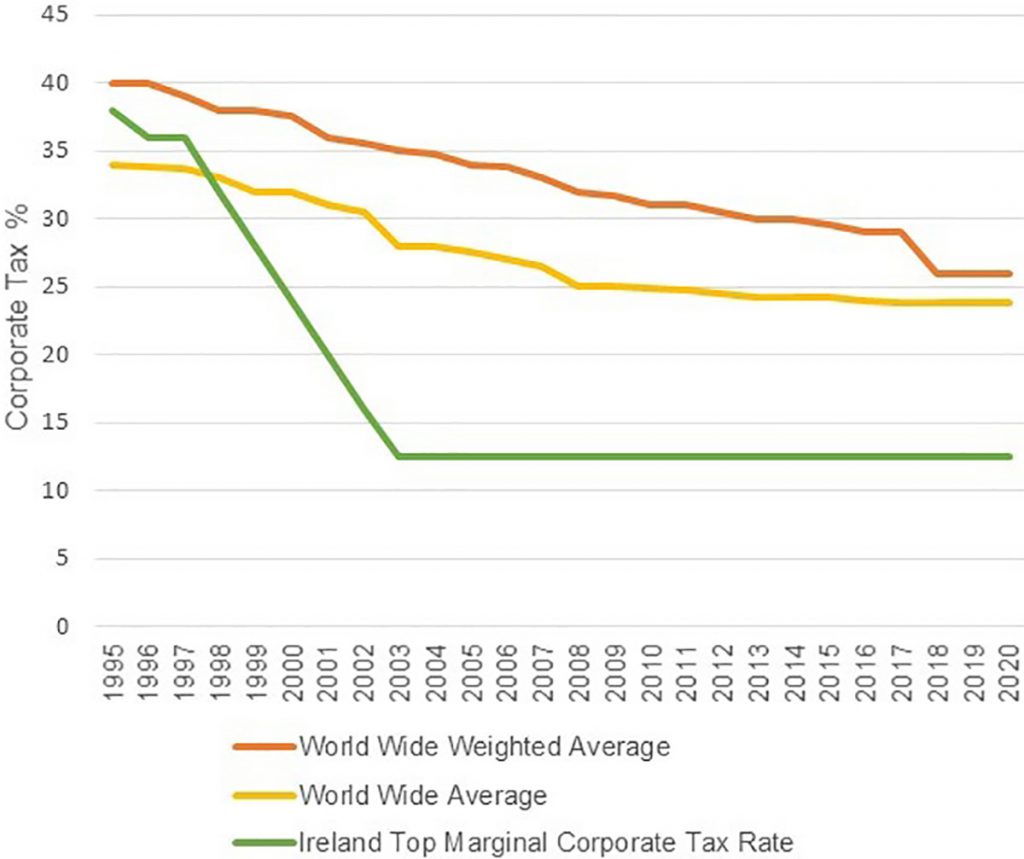

The first part of your income up to a certain amount is taxed at 20. The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line with last weeks. There are seven federal income tax rates in 2022.

We help file income tax returns for individuals across Ireland. This is known as the standard rate of tax and the amount that it. Workers on this rate will notice an increase in the money they take home which is now at 1520.

By Doug Connolly MNE Tax. Ireland Income Tax Brackets. This includes upgrading more than 6000 homes to a Building Energy Level.

The Top Rate Of Income Tax British Politics And Policy At Lse

Paying Tax In Ireland What You Need To Know

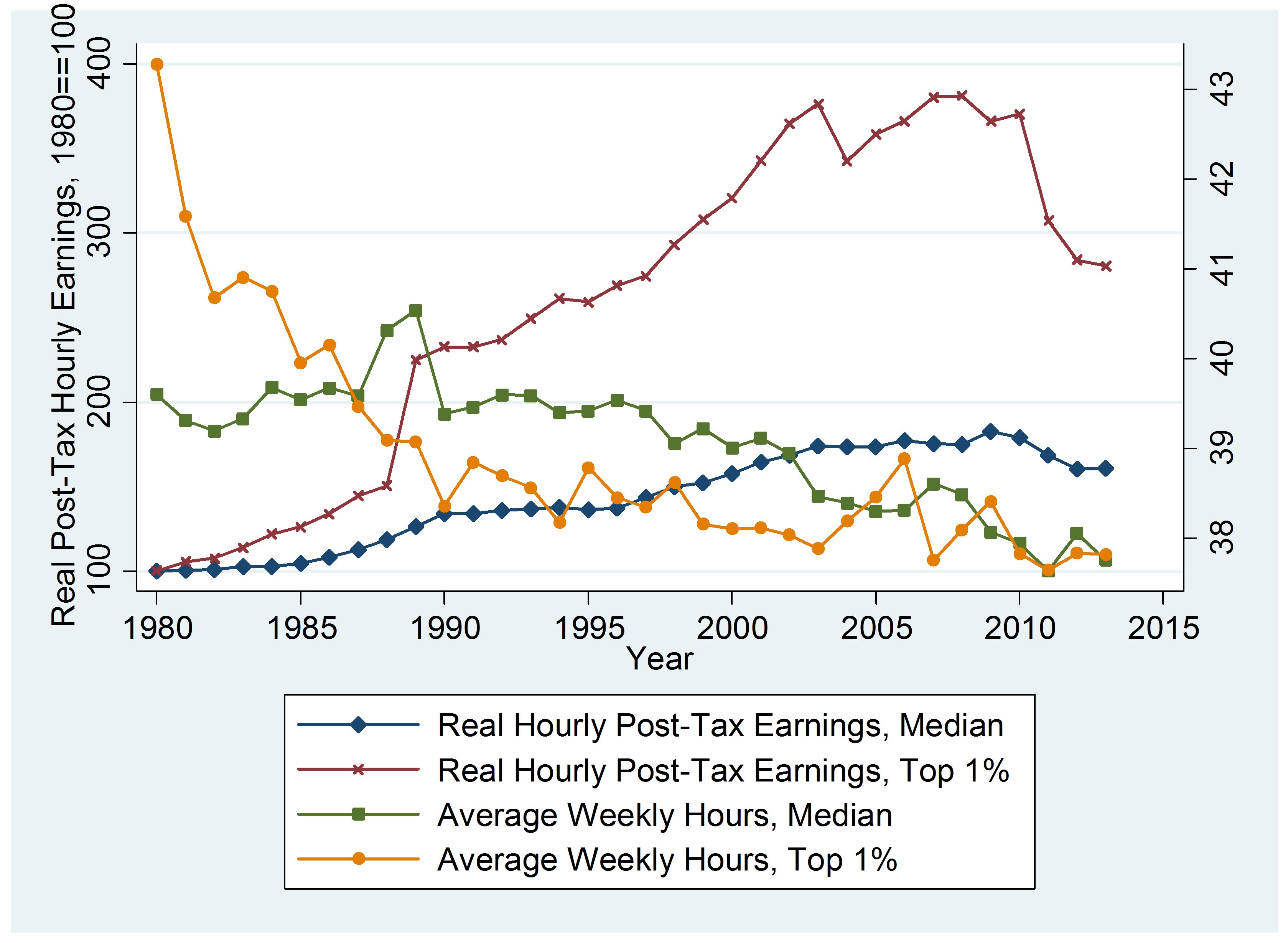

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Honduras Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Korea Tax Income Taxes In Korea Tax Foundation

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Do Taxes Affect Income Inequality Tax Policy Center

U S Individual Income Tax Tax Rates For Regular Tax Highest Bracket Iittrhb Fred St Louis Fed

2022 Corporate Tax Rates In Europe Tax Foundation

What Could A New System For Taxing Multinationals Look Like The Economist

What Are The Consequences Of The New Us International Tax System Tax Policy Center

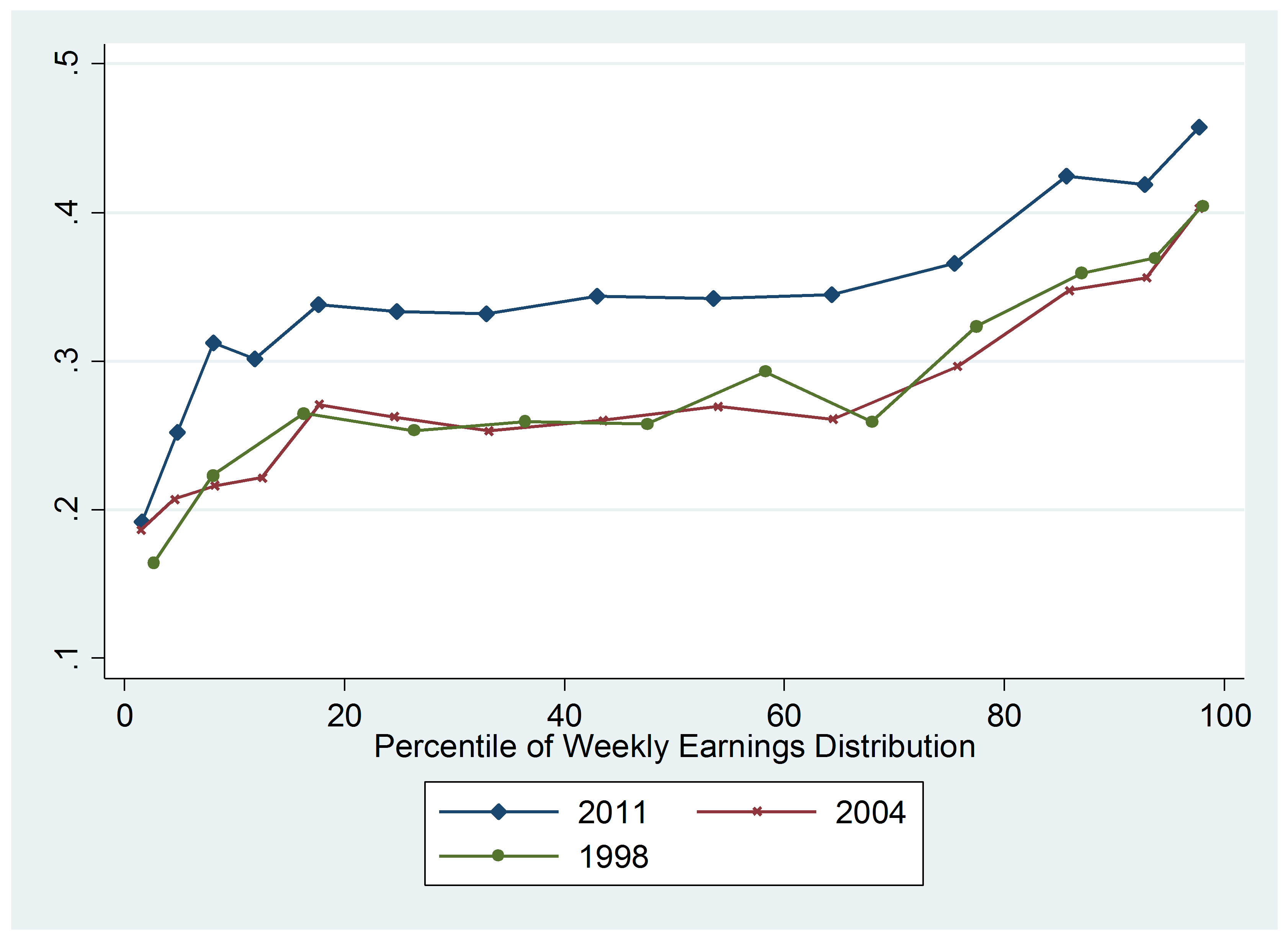

Effective Income Tax Rates In Ireland Over Time Social Justice Ireland

Biden S Minimum Corporate Tax Rate Could Destroy Ireland S Economic Growth Model Leaving The Country In Uncharted Territory The Loop

U S Individual Income Tax Tax Rates For Regular Tax Highest Bracket Iittrhb Fred St Louis Fed

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

The Top Rate Of Income Tax British Politics And Policy At Lse